can i get a mortgage if i didn't file a tax return

Can i get a mortgage if i didnt file a tax return Sunday March 20 2022 Edit The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Thuế Thu Nhập Ca Nhan ở Mỹ Vấn đề Cần Biết Cho Người Lao động Filing Taxes Tax Refund Income Tax

Learn the Upside Disadvantages.

. If youre asking yourself Can I get a mortgage with unfiled taxes then you should keep reading. Ad Highest Satisfaction for Mortgage Origination. For your 2021 tax return that you will prepare in 2022 the Child Tax Credit is expanded by the American.

In other words a married person filing separately can. Our Reverse Mortgage Calculator May Assist You In Better Understanding Eligibility Try It. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Compare Apply Directly Online. Ad Are You 62 and Have Good Credit. Apply Online To Enjoy A Service.

A computer print out of tax return information obtained directly from the IRS known as a tax transcript may substitute for a tax return as it shows the line items on the. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive. Try to get a mortgage car loan or an apartment rental all these things require your.

Our 4 step plan will help you get a home loan to buy or refinance a property. You might not get very far with the mortgage application process if you. If you dont file taxes though says La Spisa youve got all kinds of problems down the road.

To claim the credits you have to file your 1040 and other tax forms. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. If you didnt have any federal taxes withheld from your.

Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage debt on. No you will not write off your home purchase on your income tax return. After deductions and tax credits are figured in the amount paid often exceeds the actual amount owed and a tax refund is issued.

The tax law says that the home mortgage interest deduction must be cut in half in the case of a married person filing an individual return. However you are able to include certain items related to your home on your tax return.

Where S My Refund How To Track Your Tax Refund 2022 Money

Pin On Post Your Blog Bloggers Promote Here

Home Office Tax Deductions See If You Qualify Tax Deductions Deduction Small Business Success

Self Assessment Tax Returns Must Be Completed This Month Everything You Need To Know Personal Finance Finance Express Co Uk

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Calculate Tax Return Tax Return Tax Brackets Tax

How Do I Tailor My Self Assessment Tax Return Youtube

Excel Loan Repayment Calculator Debt Payoff Tracker Instant Etsy Australia Loan Payoff Mortgage Payment Calculator Repayment

Timely Tips For Filing Your 2021 Tax Return

Sports And Dating Http Www Infographicsfan Com Sports And Dating 2 Tax Return Tax Help Business Tax

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

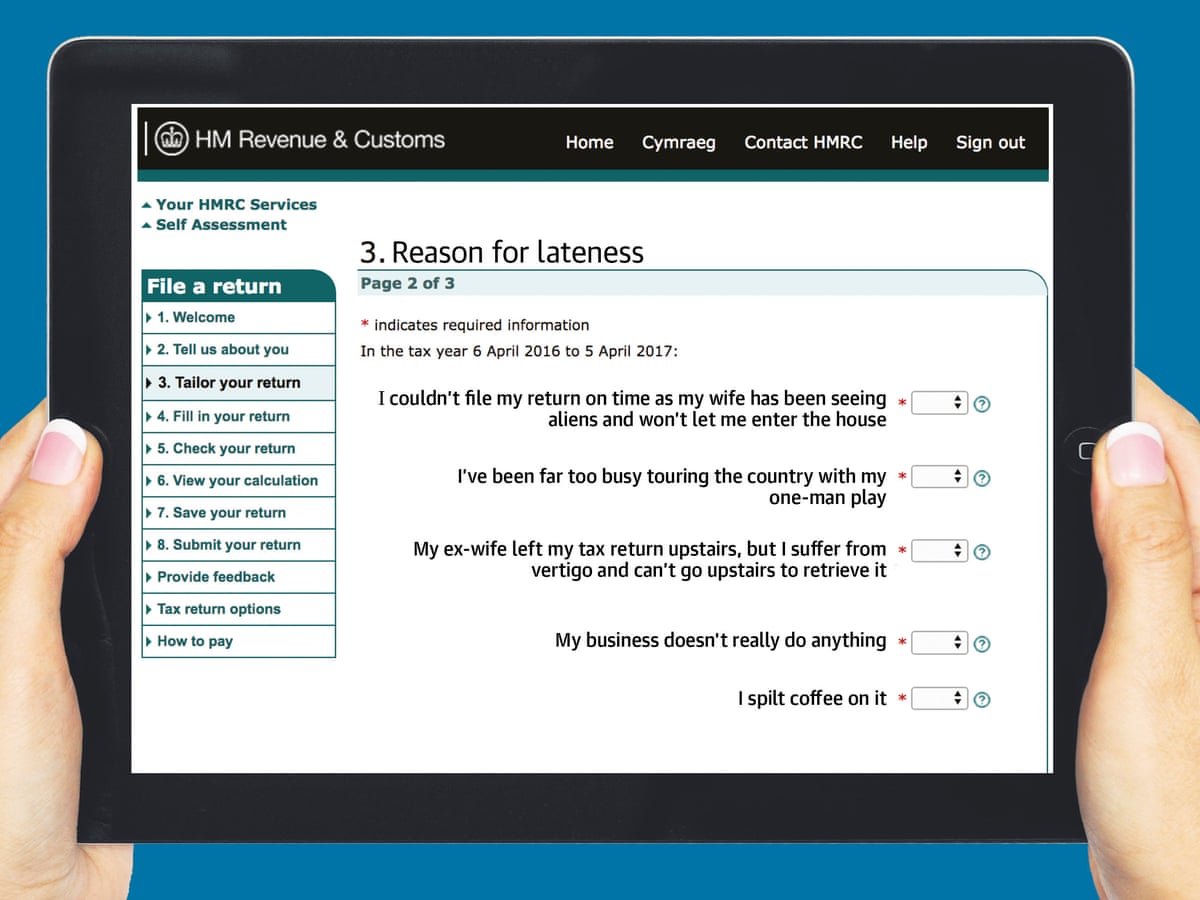

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

6 Steps To Homeownership Real Estate Agent Home Buying Process Mortgage Loan Originator

Millions Paid To File Their Taxes Last Year And Didn T Need To Tax Time Tax Return Tax Refund